Beauty

McKinsey Identifies the Gaps in Black Beauty

New study sheds light on an undeserved, yet lucrative segment within the skincare, hair care and cosmetics segments.

The global beauty industry is missing a $2.6 billion opportunity by not meeting the needs of the Black consumer, according to McKinsey. In a new study, the consulting firm concludes that Black people’s experience within the beauty industry is markedly more frustrating than that of non-Black people and filled with multiple friction points.

For example:

• Black brands make up only 2.5% of revenue in the beauty industry. Yet Black consumers are responsible for 11.1% of total beauty spending.

• Black consumers are three times more likely to be dissatisfied than non-Black consumers with their options for hair care, skin care and makeup.

• Black consumers show an affinity and preference for Black beauty brands and are 2.2 times as likely to conclude that products from those brands will work for them. However, only 4-7% of beauty brands carried by specialty beauty stores, drugstores, grocery stores, and department stores are Black brands.

• From entry-level to the C-suite and from retailers to beauty houses, only 4-5% of all employees in the US beauty industry are Black.

• Black brands in the beauty industry raise a median of $13 million in venture capital, substantially less than the $20 million that non-Black brands raise. Yet today, the median revenue of those Black brands is 89 times higher than what non-Black beauty brands return over the same period.

McKinsey concludes that better serving Black consumers and supporting Black beauty brands could lead to greater equity across the entire beauty industry—for shoppers, entrepreneurs, large beauty houses, retailers and investors.

To help remedy the situation, McKinsey offers insights for research, marketing and sales departments.

When it comes to market and product research, Black populations are often overlooked, according to McKinsey. For decades, large multinational beauty brands were focused primarily on non-Black skin and hair. The beauty executives McKinsey interviewed said they had trouble hiring Black chemists to do research in labs and also that there was underrepresentation of Black participants in clinical trials.

For Black entrepreneurs, they’re more likely to be excluded from receiving information about high-potential opportunities. Black representation in the beauty industry lags far behind Black representation in the share of beauty spending and the population at large: Black employees make up only a small percentage of employees in the beauty industry and are also underrepresented among employees at retailers selling beauty products. In fact, McKinsey estimates it will take 95 years for Black employees to reach talent parity across all levels of the private sector.

According to Nielsen, only 2% of the total money spent on advertising in the US from 2011 to 2019 went toward Black-oriented TV stations, magazines, and websites. In its focus groups, McKinsey learned many beauty advertisements didn’t resonate with Black audiences because they neither portrayed a diverse population nor spoke to people with more melanin in their skin and curls or kink in their hair. McKinsey’s focus group research suggests that 75% of Black beauty consumers can be persuaded to purchase beauty products by ads that feature various skin tones across all races. Conversely, 75% can be dissuaded from purchasing a product when an advertisement does not reflect racial diversity. According to McKinsey, Black consumers have an affinity toward Black brands and are 2.2 times more likely to conclude that products from Black brands, as compared with non-Black brands, will work for them.

Lack of availability is another problem in the Black beauty industry. Many Black neighborhoods are in “consumer deserts.” On average, Black consumers travel 3.36 miles to a specialty beauty store, about 21% further than White consumers. Black consumers also need to travel more than 17% further than White consumers to department stores to access expert customer service from behind a makeup counter. Once they get to the store, here aren’t enough brands on the shelves suitable for melanated skin or Afro-textured hair. When stores do carry them, oftentimes, Black beauty brands are out of stock, and what’s in stock is often poorly placed on shelves. Forty-seven percent of McKinsey survey respondents said they typically buy beauty products at a mass-market retailer or a grocery store, yet only 13% said it’s easy to find beauty products that meet their needs there.

If Black consumers find what they’re looking for, they often have a poor sales experience, according to the McKinsey survey. Sales associates were not knowledgeable about products for Black consumers. Only 23% of respondents said that salespeople could have sophisticated discussions about Black beauty brands and products. And only 13% said that sales associates could make knowledgeable recommendations for Black consumers. McKinsey concludes that may stem from a lack of diversity among store associates combined with insufficient systemized training of associates on Black customers’ needs and interests. McKinsey found that when there is at least one Black sales associate in the store, Black consumers are almost twice as likely to find someone who provides a very or somewhat helpful answer regarding products designed for darker skin tones.

Beauty

100+ Best Beauty Business Name Ideas

Even though there are many beauty business name ideas available, picking the right brand name can be tricky.

The beauty industry is fiercely competitive, so finding a unique name is one way to get noticed. But the question is, how do you choose the best one for your business?

Here’s our top list of name ideas for your beauty business:

- Catchy Beauty Business Name Ideas

- Unique Beauty Business Name Ideas

- One Word Beauty Business Names

- Creative Cosmetic Business Name Ideas

- Hair & Beauty Business Name Ideas

- Beauty & Wellness Business Names

- Health & Beauty Business Names

- Fashion & Beauty Business Name Ideas

- Business Name Ideas for a Natural Beauty Brand

- Classy Beauty Salon Names

- Mobile Beauty Business Names

- Cute Beauty Products Business Name Ideas

- Name Ideas for Clothes & Beauty Products

- Beauty Therapist Business Name Ideas

Catchy Beauty Business Name Ideas

- Beauty by [Your Name]

- The [Your Last Name] Beauty Salon

- [Your name] ‘s Beauty Store

- [Your name] ‘s Beauty Supply

- Beauty by Design

- The Beauty Studio

- Beautylicious

- Beauty Mark

- Polished

- The Beauty Spot

- Perfection

- Bombshell Beauty

- Pamper Me Pretty

- The Beauty Spot

- The Beauty Brigade

- Fabulous at Any Age

- Beauty by Design

- The Beauty Bar

- Pretty Please

- Beauty Junkies

- Beauty Secrets

- The Glamourous Life

- Couture Beauty

- The Beauty Connection

- Pretty in Pink

- Beauty Bliss

- Utopia

- Enchanted

- The Beauty Queen

- The Makeover Studio

- Beauty Oasis

- The Retreat

- The Femme Fatale

- The Bombshell

- The Glamazon

- The Femme Nikita

- Beauty Retreat

- Bare Escentuals

- Face Place

- Beauty Emporium

- Aqua Bling

- Beauty Boutique

- Pretty XO

- Eternal Youth

- Salon De Beaute

- Cutie Patootie

- Elegant Essence

- FormulaGlow

- Pretty Pulp

- Beautique

- Obey Your Beauty

- Pretty Fun

- Pool Noodle

- RetroCool

- EverGlowy

- TrueBeauty

- BeautyBuddies

- PrettyCherry

- PrettyPoppet

- Lucky Lipstick

- Wish U Were Here

- Sprinkles

- Pinch Me

- Escape

- Think Pink

- elly Be Thy Name

Unique Beauty Business Name Ideas

- Sweet Matter

- Self-Love Salon

- Bloom Beauty

- Diva Rose

- BeautyHour

- BeautyFable

- Lulla-Ladies

- BeautyBoard

- GleamGlow

- PrettyCrop

- Kitty Kisses

- New Age Beauty

- Modern Goddesses

- Nouveau Look

- Goddess Complexions

- La Femme

- TheRightPickUp

- BeautyRooms

- BeautyBlazer

- FancyFaceCo

- Mirror So

- Easy on the Eyes

- Bella Buzz

- The Glam Lab

- Inkwell Creative

- Skin Care Sundays

- Heavenly Goods

- Pretty Little Things

- BeautyDust

- Glam Rush

- TooGoodToGo

- DeLuxe It Up

- Blemishless

- Beauti-Full

- Dazzle Bubbly

- Tranquee

- Lilah Beauty

- Brillant

- Beau-Tiful

- Quietly Radiant

- Cover Queen

- You’re Lit

- Bold Minerals

- Club Queens

- Kendra Rose

- Heavenly Silks

- Hush Hour

- Beneath and Beyond

- Big Beauty

- Best of Your Skin

- Canvass

- Daisy and Daisy

- Eureka!

- Beautyalove

- Honeydew

- Pink Slip

- Tropical Pop

- Ivy and Mint

- Glowticity

Subscribe to Beautyholic!

Get updates on the latest posts and more from us straight to your inbox.SUBSCRIBEI consent to receiving emails and personalized ads.

One Word Beauty Business Names

- Siren

- Beautyology

- Venus

- Aphrodite

- Isis

- Cleopatra

- Nefertiti

- Allure

- Sultry

- Glam

- Luxe

- Chic

- Refined

- Timeless

- Opulent

- Splendid

- Glitz

- Fancy

- Flair

- Gleam

- Beautease

- Iridescence

- Scintillate

- Spark

- Dazzle

- Becauteous

- Glitter

- Radiance

- Beadazzled

- Lustrous

- Shine

- Resplendent

- Sheen

- Sleek

- Luminous

- Mystical

- BeautyBunch

- LuxeBeauti

- Mire

- Kyula

- Marron

- Treza

- Pique

- BareBeauty

- Beautlive

- Wildflower

- Honeybee

- She Cream

- GlowJo

- Fionull

- Cutera

- Neat-N-Even

- Layerly

- Glowy

- BerryNude

- Kalessie

- Lovelinesss

- Beautyify

- Rosebud

- Luxuriously

- Beautyous

- Bejeweled

- Onyx

- SkinMint

- Nailina

- Preen

- Quenche

- GetBeauty

- LuxReveal

- Eyelove

- Loveli

- Unblemished

- BeautyBae

- Beautypalooza

- Glamour Buzz

- Soulshine

- Dreamless

- Sweetz

- Moonfall

- Nailfection

- Lashique

- BeautyX

- Handsup

- Blushtease

- Naturess

- Vitalina

- BloomJewel

- CherIe

- TrendHead

- SweetPearl

- PearlIce

- PrettyMint

- SweetChin

- PrettySkin

- Spectabelle

- Zerobe

- Skinnia

- LaBelle

- Lalondon

- Vanitee

- Floris

- EyeLinx

- BeautyDome

- PinkTarte

- Cavale

- Entwine

- Bellita

- TotalGlow

- BeautySpot

- Glitterati

- Sweeten

- BeautyCall

- Beautica

- Magnetism

- Earthness

Creative Cosmetic Business Name Ideas

- Painted Lady

- Pretty in Pink

- The Cosmetic Kitchen

- Makeup Maven

- The Makeover Studio

- Dolled Up

- Color Me Beautiful

- Cosmetics & Co.

- Gorgeous Glam

- Makeover Magic

- Glamour Girl

- Color Dimension

- Lipstik Inc.

- Glossy Goals

- Cosmetic Secrets

- Coral Seashells

- Coralista

- Makeup Misfits

- FaceValue

- Beautitize

- Lipstick’s the New Nude

- Muddy Rose

- Cherry Lips

- Wet Aplenty

- Summer Scented

- Exfoli-tation

- Flower Scentsation

- RedsAndBombshells

- LusciousLips

- DestashingDiva

- DeGrasse

- Rosy Rose Petals

- Painted Paws

- PrimaLoss

- DeePressed

- NudeGloss

- Fantyx

- GirlyGloss

- NoMakeup

- Glitz n Glam

- Color Craze

- Playful Pout

- Plump Perfect

- Buttercream

- Powderish

- PowderFit

- Powdered

- BlankFace

- BareMarks

- MakeMePretty

- Rize

- Moodter

- Make Up Me

- Cheeky Charms

- AphroditeDerm

- UrbanLipstick

- LipsSoul

- MakeUpLife

- Acrystyle

- LipsWins

- GrinsLips

- MakeRose

- FacesNew

- BeautifulMist

- CosmeticsArt

- CosmeticsHazel

- Skinderella

- PoutBoutique

- Blush Buddy

- Lipstick Alter

- MakedUp

- BeautyBlisser

- Trumakeup

- Le Flawless

- Beautifyment

- LipMorph

- PowderCube

- Cosmeye

- Tristar

- MakeFine

- MaxLure

- Dabulous

- FlutterLash

- Mille and Haute

- StyleSand

- BeautyBot

- InfiniteChic

- Boudoir

- Smoked Lash

- Glam Stripe

- Hello Brights

- Nude You Makeup

- Chiquida

- Makeupia

- Snappy Sour

- Careful Darling

- Cosmetic Geek

- Sassy Shadow

- Boss Pretty

- Glamour Dolls

- Beautiful Kisses

- Kiss My Face

- MakeLab

- Lumicreamy

- Lasting love

- Short Sweetheart

- Lovers’ Kiss

- Hair & Beauty Business Name Ideas

- Cutting Edge

- Glossy Locks

- HairCurtain

- OliveYou

- KeratinDip

- Tressed to Impress

- The Mane Attraction

- The Cut

- A Cut Above

- Hair & Now

- Lashes & Locks

- Crowning Glory

- Curl Up and Dye

- Sugar Tressed

- Curl Custard

- Hairtreats

- Curl Blossoms

- Eve’s Garden

- Hair Carnival

- Hairstyles Unlimited

- Prima Donna Hair

- Fizz Hair

- Curls and Clicks

- Passion for Hair

- Hair Spills

- Make it Cut

- Love My Locks

- Facial Scissors

- Dye Shoppe

- HairSpa

- Locksmith

- Hair-iva

- Hairity

- Gypsy Hair

- All Hairs

- Haircuttery

- Hairlicious

- Beautyfuls

- Kera Care

- Hair Truths

- E-Luminate

- Hairpin Turn

- Lash Y’All

- Nooks and Knacks

- Twistspire

- Haircuttery

- Hairzz

- Beautyty

- Majestic Curls

- Haircut & Makeover

- Georgette’s Salon

- Hairsational Salon

- Braid Bar

- Dollish

- Knotty

- Dollin’ Around

- Hairspiration

- Curls N’ Quills

- Hair Hatches

- Hello, Handsome! Hair Parlour

- Hair Home

- Mane Attraction

- Curls & Company

- Love Your Length

- Curly Whiskers

- Beauty Splendor

- The Gleam Group

- Rocking Hair Salon

- Snip, Sip, and Style

- Hairitage

- Glow-Blow

- Bae-Stache

- Hair And Cuts

- Beautiful Hair

Why should you choose the best name for your beauty business?

A lot goes into selecting a name for your beauty or makeup business.

The biggest beauty brands usually have the most catchy and unique names. You can do this to make your business stand out from the crowd and attract clients.

Memorable names stick in people’s minds, which means they’re more likely to remember your company when they need your products.

Also, names that tell a story or carry a special meaning are especially effective.

A good name reflects your company well, so choosing one perfect for your brand is essential.

Whenever you decide to start your beauty company anywhere, come up with a name that will catch people’s attention.

How to come up with a beauty brand name?

Is your new beauty brand about to launch? Congratulations! It’s an exciting time for you and your business.

Whether you’re starting a small beauty shop or a new product line, naming is an essential part of success. Here are some tips for selecting the perfect beauty brand name.

Think about the meaning of your name

Is your brand all about natural beauty? Or maybe it’s focused on luxury and glamour?

Names should reflect what you sell and how you want to be perceived.

Choose a name that fits your brand’s feel and tone.

Check domain name availability

After you’ve come up with a few possible names, you should check if the domain name is still available. This is important because you want customers to be able to find your website easily.

Add a twist to it

Short and catchy names stick in your memory. Customers will remember your brand better when looking for beauty or makeup products.

Use SEO keywords

Your brand name should contain keywords that customers will likely use when searching for your products. It’ll help you show up on search engines.

Make it fun

When naming your business, don’t be afraid to get creative. Put your brain to work to come up with a name that stands out.

Seek feedback

The next step is to ask for feedback on the names you’ve come up with. Ask your friends, family, and even potential customers what they think of your name ideas. See which ones resonate the most and go with that.

Try a name generator

If you’re struggling to brainstorm names on your own, there are lots of online name generators that can help you come up with ideas for your new beauty brand and are free to use. Just enter a few keywords related to your brand, and you’ll get some names. Use keywords like ‘beauty store name’ or ‘beauty company name.’

Go with your gut

The bottom line is, you should pick a name that feels right to start your own beauty business. Trust your instincts and pick something that you’re proud of.

Over to you…

The sky is the limit when it comes to beauty business name ideas. The possibilities are endless.

But before settling on a name, think about what kind of brand you want to create. Do you want to create a luxury beauty brand? A natural beauty brand? A wellness beauty brand? Knowing where you want your brand to go will help you pick the perfect name for your business.

No matter what type of brand you ultimately decide to launch, we hope our list of makeup and beauty brand name ideas has given you some inspiration. Wish you luck!

Beauty

699 Original & Catchy Clothing Brand Names Ideas

Do you ever dream of starting your own clothing brand? It’s a lot of work, but it can be really rewarding. It’s fun to design clothes people love to wear. And you get to build a brand that represents your style and values.

So, if you want your clothing or a boutique business to be successful, give it a name that everyone will remember.

Here, we’ll explore unique clothing brand names that aren’t taken already so you can find your own.

- Cool Clothing Brand Name Ideas

- Unique Clothing Line Name Ideas

- Catchy Clothing Brand Name Ideas

- Exotic Clothing Brand Name Ideas

- Creative Clothing Line Names

- Luxury Clothing Names

- Traditional Names

- Urban Fashion Brand Name Ideas

- Vintage Ideas

- Plus Size

- Dog Clothes

- Baby Clothes

- Minimalist Brand Names

- Cute Clothing Brand Names

- Unique and Trendy Boutique Name Ideas

- Men’s Clothing

- Ladies Fashion

- Top Clothing Brand Names for Streetwear

- Sportswear

- Jeans

Cool Clothing Brand Name Ideas

- 21Story

- 24/7 Clothing

- Apparels 360

- Apparels Inc

- Attires Hill

- Blairs

- Couture Inc

- Couture Works

- Couturely

- Crene Crap

- Dolce Viva

- Fashion

- Fiesta

- Infinity

- Mad Colors

- Meta Cool

- Ninety Ninety’s

- Real Style

- ReVamp

- Studio9

- Style Archive

- Style Capsule

- Fashion Factory

- Style House

- Style Lab

- Suede Prime

- Style Yard

- The Cool Company

- The Couture Club

- The Shack

- The Style Club

- The Style Company

- Tiffanys

- Upstyle

- Urban Closet

- Vibe Store

- Vini Vidi

- Blue Chic

Unique Clothing Line Name Ideas

- 20/20

- 24 Karat

- Adaline’s

- Angels & Demons

- Archives

- Curves

- Euphoria

- Fleur

- French Closet

- Klothing

- Merci

- Milana

- OMG

- Penelope’s

- Riverdale

- Style Loft

- The Closet

- Très Chic

- Ubique

- Vogue

- Endless Rose

- De Novo

- Magnolia Boutique

- Sweet Repeats

- Forever New

- London Clothing Company

- Fashion Hub

- Living Simply

- Blueberry Hill

- Wear Classy

- Modern Appeal

- Unique Altered

- Primrose Shop

- 10 Days Apparel

- Zip & Buttons

- Florian Dress Shop

- Legacy Vintage

- Simply Wonderful

- The White Closet

- B&W

- Dolled Up

- Rewind

- Rack n Reroll

- Variation Vault

- This Year’s Gear

Catchy Clothing Brand Name Ideas

- Fashionista

- Threads & Trends

- Finders Keepers

- Belle Chic

- Aesthetics

- Suit Up!

- Fashionholic

- Cloud 9

- Big Bold Beautiful

- Beachy

- Abracadabra

- Bang On

- Dress R Us

- NY Wardrobe

- Sew in Style

- The Spotlight

- The Hanger

- Window Shop

- Fashion Week

- C’est la Vie

- Brooklyn 20-20

- Urban Apparels

- Seychelles

- Rehab

- Runway

- Night & Day

- Size Zero

- Knock Knock

- Viva la Vida

- Rock n Roll

- 80s Vibe

- Dots & Lines

- The Apparel Factory

- Sugar & Spice

Beauty

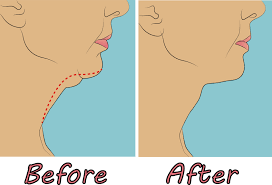

How can chin sculpting treatment help you?

Chin sculpting is a treatment that uses PRP (platelet-rich plasma) and micro-needling to give you a slimmer, more defined jawline. The procedure can be performed in a single session and takes around two hours to complete. It’s suitable for all skin types and requires no downtime, so you can return to your busy schedule immediately after treatment.

A thin face shape is often linked to a stronger jawline.

You may find yourself longing for a more robust jawline if you have a thin face shape. A weak chin can make your face appear even slimmer than it is and make you feel like your face is too narrow. However, chin sculpting treatments can give you the look of a strong jawline without having to go under the knife or resort to injectables.

Chin sculpting treatment helps add definition and weight to your jawline so that it’s more proportional to the rest of your facial features. This works well for those who aren’t looking for significant changes but want their chin area to appear more robust than it currently does to balance out other aspects of their faces, such as oversize lips or high cheekbones that stand out more prominently than other features.

Sculpting your chin can make you look younger.

It can make you look younger. Not only does this procedure help patients achieve a more balanced facial appearance, but it also makes them look more attractive. This is because the chin plays a vital role in creating the face’s overall balance and harmony. These procedures are very safe and effective, focusing on reducing excess fat from under the chin area without causing any visible scars or wounds on your face.

You don’t have to worry about allergic reactions.

It is a non-invasive treatment that uses a laser to remove fat from the area around the chin, which helps reshape and contour it. It’s also known as laser lipolysis, but whatever you call it, this procedure has many advantages over traditional methods.

- No incisions or stitches

- No pain or recovery time

- No allergic reactions

Your face will look more balanced and attractive.

It can help you achieve a more balanced face. It is also known as chin augmentation or recontouring, and it can help you achieve that perfect balance between your lower and upper facial features. By restoring balance to your face, the overall aesthetics of your visage will appreciate greatly, and so will the way you feel about yourself.

The chin is vital in helping create visual harmony in the face; however, some people have chins that are too short, too long or need to be proportioned correctly with their other facial features (such as their nose). In these cases, chin reshaping surgery may be recommended to correct these issues by either making the jawline appear longer or adding definition to its shape through contouring techniques such as shaving down bone spurs from underneath skin areas above them (known colloquially as “fat grafting”).

If you’re looking for a new way to give yourself more confidence, chin sculpting could be the answer.

It is a non-surgical procedure that can help to reshape your chin, making it look more balanced and attractive. It can also make you look younger by eliminating excess skin on the neck and jawline, which often occurs with ageing.

The treatment involves strategically placed injections of hyaluronic acid filler or fat transfer to create a more defined jawline, balanced facial features and a youthful appearance. The patient may have some swelling and bruising following this procedure, but these will usually subside after a week.

It can be carried out under local anaesthetic or conscious sedation (where you are awake but relaxed), depending on each patient’s individual needs.

-

Entertainment1 year ago

Entertainment1 year agoAdmiral casino biz login

-

Entertainment2 years ago

Entertainment2 years agoHow Much Does The Rock Weigh

-

Entertainment2 years ago

Entertainment2 years agoDownload Popular Latest Mp3 Ringtones for android and IOS mobiles

-

Entertainment2 years ago

Entertainment2 years agoTop 10 Apps Like MediaBox HD for Android and iPhone

-

LIFESTYLE2 years ago

LIFESTYLE2 years agoWhose Heartland?: The politics of place in a rural–urban interface

-

Fashion3 years ago

Fashion3 years agoHow fashion rules the world

-

Fashion Youth2 years ago

Fashion Youth2 years agoHow To Choose the Perfect Necklace for Her

-

Fashion Today2 years ago

Fashion Today2 years agoDifferent Types Of lady purse