News

How to Get Guaranteed Approval Loans for Bad Credit

If you’re looking for a loan but have bad credit, you may be wondering if it’s possible to get guaranteed approval. The short answer is no – there is no such thing as a guaranteed loan for bad credit. However, that doesn’t mean you can’t find a loan that will work for you. In this blog post, we’ll discuss how to get a payday loans for bad credit, as well as some of the best loans for bad credit available. We’ll also provide alternatives to loans for those with bad credit.

How to Get Guaranteed Approval Loans for Bad Credit.

A bad credit score is generally considered to be a score below 630. Scores are calculated by credit bureaus using a variety of information from your credit report, and they can range from 300 to 850. A low credit score can make it difficult to get approved for loans, credit cards, and other forms of financing. It can also lead to higher interest rates and fees.

How to get a loan with bad credit.

There are a few options for getting a loan with bad credit:

1) Personal Loans: Personal loans are typically unsecured, meaning they don’t require collaterallike a car or home equity. This makes them a good option if you don’t have any assets to use as collateral. There are many online lenders that cater to people with bad credit, and you can usually get an approval decision quickly. The downside is that personal loans tend to have higher interest rates than other types of loans, so you’ll need to carefully consider whether the monthly payments are manageable.

2) Payday Loans: Payday loans are short-term loans that are typically due on your next payday. They’re often used by people who need cash quickly but may not have access to other forms of financing. While payday loans can be helpful in emergency situations, they come with high interest rates and fees that make them difficult to repay over the long term.

3) Title Loans: Title loans use your car as collateral, which means you could lose your vehicle if you default on the loan. They tend to have very high interest rates and should only be used as a last resort when you absolutely need funds and have no other options available.

4) Bad Credit Credit Cards: There are a few different types of bad credit cards available, but they all come with relatively high fees and interest rates. However, if used responsibly, they can help you rebuild your credit score over time by reporting your positive payment history to the major credit bureaus each month.

How to improve your credit score.

There are a few things you can do to improve your credit score:

1) Check your credit report for errors and dispute any inaccuracies.

2) Make all of your payments on time, including utility bills, credit card bills, etc.

3) Pay down your debt, especially high-interest debt, as much as possible.

4) Use a credit monitoring service to track your progress and get alerts if there are any changes to your credit report.

Types of Loans for Bad Credit.

Personal loans for bad credit are available from a number of different sources, including banks, credit unions, and online lenders. While each lender will have its own requirements for eligibility, in general you’ll need to have a regular income and a good credit history in order to qualify. Interest rates on personal loans for bad credit will be higher than for those with good credit, but if you shop around you should be able to find a competitive rate.

Payday Loans.

Payday loans are designed to provide short-term financial assistance, and are typically due to be repaid when you receive your next paycheck. These loans can be easy to get approved for, but they come with high interest rates and fees which can make them very expensive in the long run. If you’re considering a payday loan, make sure you understand all the terms and conditions before signing anything.

Title Loans.

Title loans are another option for those with bad credit who need access to cash quickly. These loans use your vehicle as collateral, so if you default on the loan you could lose your car. title loans tend to have very high interest rates, so they should only be used as a last resort. Make sure you understand all the terms and conditions of a title loan before signing anything.

2 .4 Bad Credit Credit Cards

Bad credit cards are an option for people with poor credit who want to rebuild their credit score by using a credit card responsibly . While most bad credit cards have high interest rates , there are some that offer 0% introductory APR periods which can help save on interest charges . Be sure to compare offers from different issuers before choosing a bad credit card .

The Best Loans for Bad Credit.

Avant is a great option for borrowers with bad credit who need a loan quickly. You can apply for a loan online in just a few minutes, and if you’re approved, you could have the money in your account as soon as the next business day. Avant offers both personal loans and lines of credit, so you can choose the best option for your needs.

A personal loan from Avant can be used for anything from consolidating debt to paying for an unexpected expense. Loans are available from $2,000 to $35,000, and you’ll have between 24 and 60 months to repay the loan. One thing to keep in mind is that Avant personal loans come with origination fees ranging from 4.75% to 29.99%, so be sure to factor that into your repayment plans.

If you need a little more flexibility, an Avant line of credit gives you access to funds whenever you need them up to your credit limit. There’s no origination fee or prepayment penalty, and you only pay interest on the amount of money you borrow. Lines of credit are available from $1,000 to $35,000.

OneMain Financial

OneMain Financial is one of the largest lenders of personal loans in the country. They offer both secured and unsecured loans, so even if you have bad credit, you may be able to qualify for a loan by putting up collateral such as your car or home equity. OneMain Financial offers loans from $1,500 up to $30,000 with terms ranging from 12 to 60 months depending on the loan amount and your state of residence. The APR on OneMain Financial loans is high – up to 35% – but that’s not unusual for bad credit loans.

OneMain Financial also has physical branches in 44 states where you can meet with a loan officer face-to-face if you prefer not to apply online or over the phone. This can give borrowers a sense of security when taking out a large loan, knowing they can put a human face to their lender if any problems arise during repayment.

Prosper

Prosper is a peer-to-peer lending platform, meaning you’re borrowing money from individual investors rather than a financial institution. Prosper personal loans are available for borrowers with good or bad credit, and loan amounts range from $2,000 to $40,000 with terms of three or five years. The APR on Prosper loans is high – up to 35.99% – but that’s not unusual for bad credit loans.

One thing to keep in mind with Prosper is that there is a origination fee of 2.41% to 5%, so be sure to factor that into your repayment plans. Also, because Prosper is a peer-to-peer lending platform, it can take up to 10 days for your loan to be funded after you’ve been approved. So if you need the money quickly, Prosper may not be the best option.

BadCreditLoans.com

BadCreditLoans.com is a website that matches borrowers with lenders who are willing to work with them despite their bad credit. You can apply for a loan online in just a few minutes, and if you’re approved, you could have the money in your account as soon as the next business day. Loans are available from $500 to $5,000, and terms range from three months to 36 months depending on the loan amount and your state of residence. The APR on BadCreditLoans.com loans is high – up to 35% – but that’s not unusual for bad credit loans.

One thing to keep in mind with BadCreditLoans.com is that there is an origination fee of up to 5%, so be sure to factor that into your repayment plans. Also, because BadCreditLoans.com is a matching service, it can take up to 10 days for your loan to be funded after you’ve been approved. So if you need the money quickly, BadCreditLoans.com may not be the best option.

Alternatives to Loans for Bad Credit.

When you have bad credit, it can be difficult to get a loan from a bank or other traditional lender. However, you may still be able to borrow money from family or friends. If you go this route, make sure to put everything in writing and agree on terms up front, such as when the loan will be repaid and what the interest rate will be.

Get a co-signer.

If you have bad credit, one option is to find someone with good credit who is willing to co-sign for a loan with you. This means that they will be responsible for making the payments if you default on the loan. Before asking someone to co-sign, make sure that you are confident that you will be able to make the payments and that the person understands the risks involved.

Use a credit card.

If you have bad credit, another option is to use a credit card instead of taking out a loan. Credit cards typically have higher interest rates than loans, but they can still be a cheaper option than some payday or title loans. When using a credit card, just be sure to make your payments on time and in full each month to avoid getting into further debt.

Find a cosigner for a lease.

If you’re looking for an alternative to taking out a loan, one option is to find someone who is willing to cosign for a lease with you. This means that they will be responsible for making the payments if you default on the lease agreement. As with any other type of loan, make sure that you are confident that you will be able to make the payments before asking someone to cosign for you.

Conclusion

If you’re looking for a loan but have bad credit, you may be wondering how to get guaranteed approval. While there’s no such thing as a guaranteed loan, there are still plenty of options available to those with less-than-perfect credit. In this blog post, we’ll explore how to get a loan with bad credit, what types of loans are available, and the best loans for bad credit. With this information in hand, you’ll be able to make an informed decision about the best way to finance your needs.

News

What’s Involved in the Personal Injury Claim Process

If you have sustained injuries because of another person’s negligence can file a personal injury claim to seek damages. However, it can feel complicated if it is your first time going through the claim process. Because of this, you can make mistakes. Sadly, even a simple mistake in this type of case can decrease your odds of securing compensation for your injuries. To avoid these mistakes, you should seek legal advice from an experienced personal injury attorney.

It’s not a legal requirement to hire an attorney to file an injury claim. However, hiring an attorney is usually the first step. The right lawyer can help you throughout each step of the process, which includes ensuring you have the right to sue. Below are the steps involved in the personal injury claim process:

Screening

As the injured party who wants to initiate a lawsuit, you must contact a lawyer for a consultation first. This allows you to talk about your case and the injuries you have suffered. During this consultation, the attorney may ask you to sign a document that authorizes them to access your medical records. The lawyer will ask about your insurance coverage, whether an insurance adjuster has contacted you, and what transpired during your conversation with them.

Once the lawyer accepts the case, they will thoroughly investigate the accident. This includes speaking with witnesses, collecting and preserving evidence, and contacting insurance companies.

Settlement Negotiations

Before you file a lawsuit, your lawyer will contact the insurance company of the at-fault party to determine if they can reach a fair settlement of your case before you to go court. Based on the circumstances and facts of your case, your lawyer drafts a demand letter with a settlement amount and send this to the insurance company. If both parties cannot reach an agreement, litigation can ensue.

Complaint Filing and Serving

Your lawyer will file the complaint with the court, triggering the litigation process. Then, the defendant will get a summons that notify them of your complaint and the amount of time they have to respond to it.

Discovery

During the discovery process, lawyers for both sides gather details and testimony, documents, and evidence related to the case. Discovery comes in the form of written discovery, depositions, and production of documents.

The discovery process is then followed by hiring expert witnesses, filing pre-trial motions, and going through mediation. These steps are meant to try to help both parties settle their case before going to trial. However, if they fail to resolve their issues during these steps trial will occur in court.

News

Hh gregg A Tale of Retail Resilience and Transformation

In the world of retail, few names are as iconic as hh gregg. This article delves into the fascinating journey of this retail giant, from its inception to its rebranding as Gregg’s, and the impact it left on the retail market.

| Heading | Subheading |

|---|---|

| Introduction | |

| The Rise and Fall | |

| Rebranding as Gregg’s | |

| Products and Services | |

| Customer Experience | |

| Online Presence | |

| Impact on Retail Market | |

| Conclusion |

Introduction

Once a household name in the electronics and appliances retail industry, hh gregg was known for its wide range of products and exceptional customer service. However, its story is not just one of success but also resilience and transformation.

The Rise and Fall

hh gregg’s rise to prominence was meteoric. Established in 1955 by Henry Harold Gregg and his wife, Fansy, as an appliance and electronics store in Indianapolis, Indiana, the company quickly expanded its footprint across the United States. With its commitment to delivering quality products and personalized service, hh gregg became a go-to destination for consumers seeking appliances, electronics, and more.

The fall of hh gregg, on the other hand, was equally dramatic. In 2017, the company filed for bankruptcy and subsequently closed all its stores. The reasons behind this decline were complex, including increased competition and changing consumer preferences.

Rebranding as Gregg’s

Despite the setback, the hh gregg story didn’t end there. The company underwent a remarkable transformation and rebranded itself as Gregg’s. This rebranding effort aimed to leverage the brand’s legacy while adapting to the changing retail landscape.

Products and Services

Gregg’s continued to offer a wide array of products, including appliances, electronics, and furniture. However, it also diversified into new categories such as smart home technology, emphasizing innovation and staying up-to-date with consumer demands.

Customer Experience

One thing that remained unchanged was Gregg’s commitment to customer experience. The brand focused on delivering exceptional service, ensuring that customers felt valued and supported in their purchasing decisions.

Online Presence

In the digital age, Gregg’s recognized the importance of an online presence. They invested in user-friendly websites and mobile apps, making it convenient for customers to browse, purchase, and track their orders from the comfort of their homes.

Impact on Retail Market

Gregg’s reentry into the retail scene had a significant impact. The company’s success story served as a beacon of hope for the retail industry, showcasing that reinvention and adaptation could breathe new life into even the most established brands.

Conclusion

In conclusion, the transformation of hh gregg into Gregg’s is a testament to the resilience and adaptability of retail brands. It demonstrates the importance of understanding customer needs and embracing change to thrive in an ever-evolving market.

FAQs

1. What led to hh gregg’s decline and bankruptcy?

The decline of hh gregg was influenced by factors like increased competition, changing consumer preferences, and financial challenges.

2. How did Gregg’s rebrand itself successfully?

Gregg’s successfully rebranded by diversifying its product offerings, focusing on customer experience, and establishing a robust online presence.

3. What products can I find at Gregg’s today?

Gregg’s offers a wide range of products, including appliances, electronics, furniture, and smart home technology.

4. How can I access Gregg’s online services?

You can easily access Gregg’s products and services through their user-friendly website and mobile app.

5. What can other retailers learn from Gregg’s transformation?

Other retailers can learn that adaptability and a customer-centric approach are key to surviving and thriving in the dynamic retail market.

News

Sonic Youth: The Revolutionary Band That Redefined Alternative Music

Sonic Youth was a groundbreaking band that emerged in the early 1980s and quickly became a significant influence on the alternative music scene. Combining elements of punk rock, noise, and experimental music, the band created a distinctive sound that challenged conventional ideas about music and paved the way for countless other artists to explore new sonic possibilities.

In this article, we will explore the history of Sonic Youth, their impact on the music world, and their enduring legacy. From their early days in New York City’s vibrant downtown scene to their final performance in 2011, we will examine the band’s journey and celebrate their contributions to alternative music.

Introduction to Sonic Youth

Sonic Youth formed in 1981 in New York City’s Greenwich Village, where they quickly established themselves as a force to be reckoned with in the underground music scene. The band consisted of Thurston Moore, Lee Ranaldo, Kim Gordon, and Steve Shelley, and their sound was characterized by dissonant guitars, unconventional song structures, and a willingness to experiment with noise and feedback.

Early Years and Rise to Fame

Sonic Youth’s early years were marked by a series of independent releases and collaborations with other artists. However, it was their 1988 album “Daydream Nation” that propelled them to international fame and critical acclaim. The album was hailed as a masterpiece and remains one of the most influential alternative albums of all time.

Sonic Youth’s Unique Sound

Sonic Youth’s sound was defined by their use of alternate guitar tunings, unorthodox playing techniques, and a willingness to experiment with noise and feedback. This approach was heavily influenced by avant-garde composers like John Cage and minimalists like La Monte Young. The band’s willingness to push the boundaries of what was considered acceptable in popular music helped to redefine the alternative music scene and paved the way for countless other artists to experiment with sound.

Sonic Youth’s Impact on Alternative Music

Sonic Youth’s impact on alternative music cannot be overstated. The band’s willingness to experiment with sound and push the boundaries of what was considered acceptable in popular music paved the way for countless other artists to explore new sonic possibilities. Bands like Nirvana, Pixies, and Sonic Youth’s own record label, SST Records, were all heavily influenced by the band’s unique sound and approach to music.

Sonic Youth’s Legacy

Sonic Youth’s legacy continues to live on in the music of countless other artists. The band’s willingness to experiment with sound and push the boundaries of what was considered acceptable in popular music helped to redefine the alternative music scene and paved the way for countless other artists to explore new sonic possibilities. Sonic Youth’s influence can be heard in the music of bands like My Bloody Valentine, Radiohead, and Arcade Fire, to name just a few.

Conclusion

Sonic Youth was a band that redefined what was possible in alternative music. Their unique sound, willingness to experiment with noise and feedback, and refusal to be bound by conventional song structures helped to pave the way for countless other artists to explore new sonic possibilities. Sonic Youth’s legacy continues to live on in the music of countless other artists, and their influence on alternative music will be felt for generations to come.

FAQs

- When did Sonic Youth form?

- Sonic Youth formed in 1981 in New York City’s Greenwich Village.

- Who were the members of Sonic Youth?

- The band consisted of Thurston Moore, Lee Ranaldo, Kim Gordon, and Steve Shelley.

- What was Sonic Youth’s unique sound?

- Sonic Youth’s sound was characterized by dissonant guitars, unconventional song structures, and a willingness to experiment with noise and feedback.

- What was Sonic Youth’s most influential album?

-

Entertainment1 year ago

Entertainment1 year agoAdmiral casino biz login

-

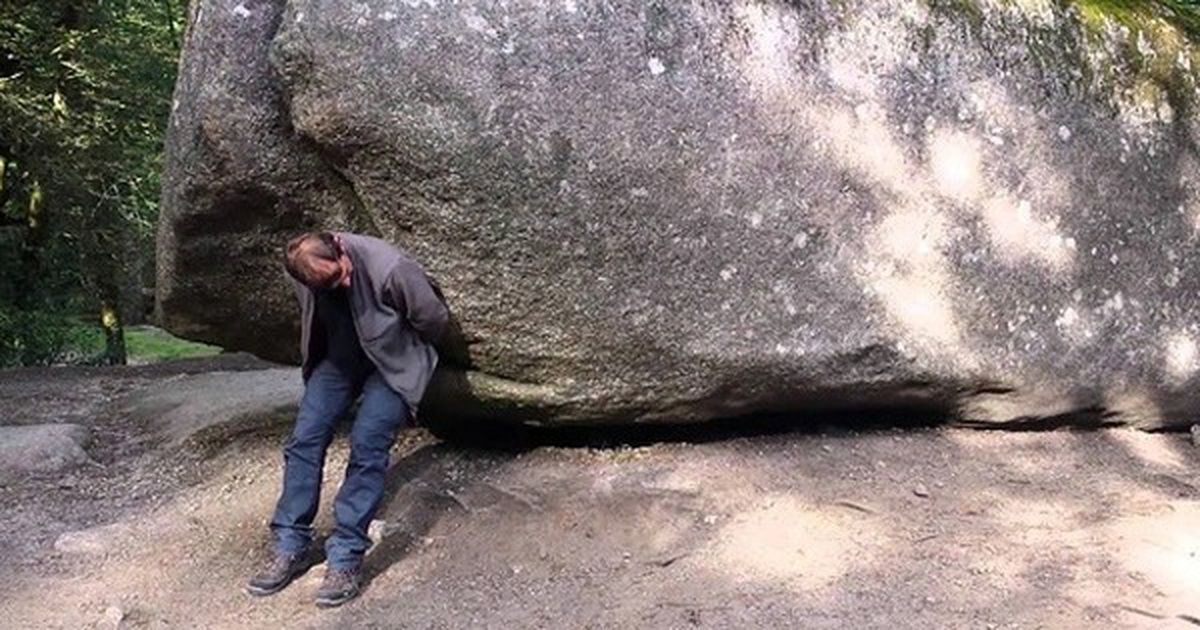

Entertainment2 years ago

Entertainment2 years agoHow Much Does The Rock Weigh

-

Entertainment2 years ago

Entertainment2 years agoDownload Popular Latest Mp3 Ringtones for android and IOS mobiles

-

Entertainment2 years ago

Entertainment2 years agoTop 10 Apps Like MediaBox HD for Android and iPhone

-

LIFESTYLE2 years ago

LIFESTYLE2 years agoWhose Heartland?: The politics of place in a rural–urban interface

-

Fashion3 years ago

Fashion3 years agoHow fashion rules the world

-

Fashion Youth2 years ago

Fashion Youth2 years agoHow To Choose the Perfect Necklace for Her

-

Fashion Today2 years ago

Fashion Today2 years agoDifferent Types Of lady purse