Business

How to Get a Bad Credit Loan Guaranteed Approval

Bad credit can make it difficult to get a loan, but there are options available for those with less-than-perfect credit. A bad credit loan is a type of loan specifically designed for borrowers with poor credit. There are several different types of bad credit loans, including secured and unsecured loans, as well as loans from traditional lenders and online lenders.

For those with bad credit, getting a loan can be a challenge. However, there are ways to increase your chances of approval, such as improving your credit score or finding a cosigner. Applying for a loan from a traditional lender or an online lender is also an option.

If you’re looking for a bad credit loan with guaranteed approval, there are several things you can do to improve your chances of getting approved. First, work on improving your credit score. This will give you a better chance of qualifying for a loan and getting better terms and rates. You can also try finding a cosigner who can help guarantee the loan. Finally, apply for the loan from a traditional lender or online lender that specializes in bad credit loans.

What is a Bad Credit Loan.

Bad credit loans are a type of loan specifically designed for people with bad credit. There are different types of bad credit loans, including secured and unsecured loans, as well as short-term and long-term loans.

How Do Bad Credit Loans Work.

Bad credit loans work by providing funding to people with bad credit who may not be able to get a loan from a traditional lender. These loans typically have higher interest rates and may require collateral, such as a car or home equity.

How to Get a Bad Credit Loan Guaranteed Approval.

One of the best ways to get a bad credit loan guaranteed approval is to improve your credit score. There are a few things you can do to improve your credit score, including:

• Pay your bills on time. This is one of the most important factors in determining your credit score.

• Reduce your debt. The less debt you have, the better your credit score will be. You can do this by paying off your debts, or by consolidating your debts into one loan with a lower interest rate.

• Use a credit counseling service. Credit counseling services can help you get out of debt and improve your credit score. They will work with you to create a budget and negotiate with your creditors to lower your interest rates and monthly payments.

Find a Cosigner.

Another way to get a bad credit loan guaranteed approval is to find a cosigner for the loan. A cosigner is someone who agrees to repay the loan if you default on it. This can be a friend or family member with good credit who is willing to help you out. Having a cosigner can increase your chances of getting approved for a loan, as well as getting a lower interest rate.

Apply for a Loan.

Once you have improved your credit score and found a cosigner, you can apply for a bad credit loan from lenders that specialize in loans for people with bad credit. Be sure to shop around and compare rates before choosing a lender, as interest rates can vary greatly among lenders. Also, make sure you understand all the terms of the loan before signing any paperwork.

Conclusion

A bad credit loan is a type of loan offered to borrowers with poor credit history. There are many different types of bad credit loans, but they all work by giving you access to funds that you wouldn’t otherwise be able to get.

If you’re looking for a bad credit loan with guaranteed approval, there are a few things you can do to improve your chances. First, work on improving your credit score. The higher your score, the better your chances of getting approved. Second, find a cosigner who can help guarantee the loan. And finally, apply for a loan from a lender that specializes in bad credit loans.

By following these steps, you can increase your chances of getting approved for a bad credit loan.

Business

Business services in China for Russian entrepreneurs business china.ru

Expanding your business into China can be a lucrative endeavor for Russian entrepreneurs looking to tap into one of the world’s largest and fastest-growing markets. However, entering a new business landscape can be challenging without a solid understanding of the local business services and practices. This article aims to provide valuable insights and guidance for Russian entrepreneurs seeking success in China through the lens of the https://business-china.ru/ platform.

Market Research and Entry Strategies

Before diving into the Chinese market, Russian entrepreneurs should conduct thorough market research to understand the unique dynamics, consumer behavior, and competitive landscape. Platforms like business-china.ru can offer valuable resources, market reports, and insights to help entrepreneurs make informed decisions. Additionally, consider seeking advice from experts who specialize in cross-border business to tailor entry strategies to the specific needs of your industry.

Legal and Regulatory Compliance

Navigating the complex legal and regulatory environment is crucial for any foreign business in China. Business-china.ru can serve as a hub for legal guidance, providing information on business structures, intellectual property rights, and compliance requirements. Entrepreneurs should engage local legal experts to ensure their business operations align with Chinese laws and regulations.

Partnering and Networking

Building strong relationships with local partners is essential for success in the Chinese market. Business-china.ru can be a valuable platform for networking, connecting Russian entrepreneurs with potential business partners, suppliers, and distributors. Attend industry-specific events, join online forums, and leverage social media platforms to establish a strong network within the Chinese business community.

Language and Cultural Understanding

Effective communication is key to building successful business relationships. While English is widely used in the business world, having a basic understanding of Mandarin can significantly enhance your interactions and negotiations. Business-china.ru may offer language learning resources and cultural insights to help bridge communication gaps and foster positive relationships with Chinese counterparts.

Financial and Banking Services

Understanding the financial landscape and banking services in China is crucial for smooth business operations. Business-china.ru can provide information on local banking practices, currency regulations, and tax implications. Entrepreneurs should work closely with financial experts to optimize their financial strategies and comply with Chinese tax laws.

Marketing and Branding Strategies

Adapting your marketing and branding strategies to the Chinese market is essential for capturing the attention of local consumers. как найти поставщика из китая напрямую may offer insights into effective digital marketing channels, social media platforms, and cultural nuances that can impact your brand’s success. Collaborate with local marketing agencies to create campaigns that resonate with the target audience.

HOW TO FIND A SUPPLIER

In the dynamic world of global commerce, the appeal of sourcing products directly from China is undeniable. With its vast manufacturing capabilities and competitive prices, China has become a go-to destination for businesses looking to find reliable suppliers. However, the process of locating a supplier directly, without involving intermediaries, can be challenging for those unfamiliar with the intricacies of the Chinese business landscape. This guide aims to demystify the steps involved in finding a supplier from China directly on business-china.ru, a platform that facilitates business connections between international buyers and Chinese suppliers.

1. Understand Your Product and Industry:

Before diving into supplier searches, it’s crucial to have a clear understanding of the product you are looking to source and the specific requirements of your industry. This knowledge will help you narrow down your search and find suppliers with the expertise and capabilities to meet your needs.

2. Research business-china.ru:

business-china.ru is a platform designed to connect international buyers with Chinese suppliers. Familiarize yourself with the platform’s features, registration process, and user interface. Take advantage of any search filters and categories available on the platform to streamline your search.

3. Create an Account:

To access the full range of features on business-china.ru, create an account. This step is typically straightforward and involves providing basic information about your business and sourcing needs. Ensure that your profile is complete and accurately reflects your requirements.

4. Use Advanced Search Filters:

business-china.ru offers advanced search filters that allow you to narrow down your supplier search based on various criteria such as product category, location, and certification. Utilize these filters to refine your search and find suppliers that align with your specific requirements.

5. Verify Supplier Profiles:

Once you’ve identified potential suppliers, thoroughly review their profiles. Look for key information such as company background, product range, certifications, and customer reviews. business-china.ru often provides a platform for users to leave reviews, offering valuable insights into the reliability of a supplier.

6. Communicate Directly:

Establish direct communication with shortlisted suppliers. Clarify your product specifications, quality standards, and any other requirements you may have. Effective communication is key to building a strong partnership and ensuring that both parties are on the same page.

7. Verify Credentials:

Request and verify relevant credentials such as business licenses, certifications, and product testing reports. This step is crucial to ensure that the supplier complies with industry standards and regulations.

8. Negotiate Terms:

Negotiate terms, including pricing, minimum order quantities, lead times, and payment terms. Be clear and transparent about your expectations, and strive to reach a mutually beneficial agreement.

9. Request Samples:

Before committing to a large order, request product samples to assess quality. This step allows you to verify that the supplier can meet your standards and expectations.

10. Conduct Due Diligence:

Before finalizing any agreements, conduct thorough due diligence on the selected supplier. This includes checking references, reviewing contracts, and possibly visiting the supplier’s facilities if feasible.

Navigating Chinese Business Etiquette: Key Features to Consider

In the global landscape, understanding and respecting cultural nuances is essential for successful business interactions. When it comes to engaging with Chinese partners and clients, adherence to Chinese business etiquette can significantly impact the outcome of your endeavors. Business etiquette in China is deeply rooted in tradition, reflecting the country’s rich history and cultural values. In this article, we will explore the key features of Chinese business etiquette that you should consider, drawing insights from reputable sources like business-china.ru.

- Greetings and Introductions:

Chinese business etiquette places a strong emphasis on formal greetings and introductions. When meeting someone for the first time, a handshake is common, accompanied by a slight nod of the head. Address individuals using their titles and last names, demonstrating respect for hierarchy and seniority. Business-china.ru highlights the importance of presenting and receiving business cards with both hands, showing deference to the information presented.

- Communication Style:

Communication in Chinese business settings tends to be indirect and nuanced. It is crucial to be mindful of non-verbal cues and to read between the lines. Business-china.ru emphasizes the value of maintaining a calm and composed demeanor, avoiding confrontational or aggressive behavior. Patience is key, as building relationships takes time, and decisions are often made collectively.

- Dining Etiquette:

Sharing a meal is a common practice for building relationships in Chinese business culture. Understanding proper dining etiquette is vital. Business-china.ru advises being punctual for meals, accepting offerings with both hands, and using serving utensils rather than reaching across the table. Demonstrating appreciation for the cuisine and engaging in small talk during meals can further foster positive relationships.

- Gift-Giving Etiquette:

Gift-giving is a significant aspect of Chinese business culture, symbolizing goodwill and respect. When presenting a gift, business-china.ru recommends offering it with both hands and expressing humility. Avoid overly expensive gifts, as they may be perceived as inappropriate. Gifts should be opened in private to avoid putting the recipient in an uncomfortable position.

- Business Attire:

Professional appearance is highly regarded in Chinese business culture. Business-china.ru suggests dressing conservatively and in formal attire. Dark-colored suits are commonly worn, and women should opt for modest and elegant clothing. The emphasis on a polished appearance reflects the importance of projecting a professional image.

- Understanding Hierarchy:

Respect for hierarchy is deeply ingrained in Chinese culture. Business-china.ru advises addressing individuals by their titles and acknowledging seniority in both age and position. It’s essential to be aware of the hierarchical structure within organizations and show deference to those in higher-ranking positions.

Key Considerations for Success

As global markets continue to evolve, establishing business relationships with Chinese companies has become increasingly vital for international success. However, negotiating with Chinese counterparts requires a nuanced understanding of cultural, legal, and business practices unique to the region. In this article, we will explore key considerations for businesses engaging in negotiations with Chinese companies, shedding light on the intricacies that can influence the outcome of these crucial interactions.

Understanding Cultural Nuances:

- Building Guanxi: In China, relationships are often valued as much as the business itself. The concept of guanxi, or personal connections, plays a significant role in Chinese business culture. Building and nurturing strong relationships with your Chinese counterparts can contribute to long-term success. This involves investing time in getting to know your partners on a personal level, demonstrating trustworthiness, and maintaining a sense of reciprocity.

- Face and Hierarchy: “Face” is a crucial concept in Chinese culture, representing reputation, dignity, and social standing. Maintaining face for both parties is essential during negotiations. Additionally, respecting hierarchical structures within Chinese companies is vital. Decision-making often involves consultation with senior executives, and it’s crucial to understand and respect these protocols.

Legal Considerations:

- Navigating Chinese Law: Familiarizing yourself with Chinese business laws and regulations is indispensable. This includes understanding contract laws, intellectual property regulations, and other legal frameworks that may impact your negotiations. Engaging legal experts who specialize in Chinese business law can provide invaluable guidance and ensure compliance.

- Local Partnerships: Collaborating with local partners can offer a competitive advantage. Chinese companies often appreciate working with businesses that have established relationships or joint ventures with local entities, as this demonstrates a commitment to understanding and respecting the local market.

Business Practices:

- Patience and Long-Term Perspective: Patience is a virtue in Chinese business negotiations. Rushing the process may be perceived as a lack of commitment or understanding. Adopting a long-term perspective and showing dedication to the relationship-building process can set a solid foundation for successful collaboration.

- Thorough Due Diligence: Conducting thorough due diligence on your potential Chinese partners is crucial. This includes researching their financial stability, reputation, and past business dealings. Additionally, seeking references from other businesses that have worked with your potential partner can provide valuable insights.

Communication:

- Clarity and Precision: Clear and precise communication is essential in cross-cultural negotiations. Language barriers may exist, so it’s crucial to ensure that all parties have a comprehensive understanding of the terms and conditions. Using interpreters or translators, if necessary, can facilitate smooth communication.

- Written Agreements: Formalizing agreements in writing is standard practice in Chinese business culture. A well-drafted contract should cover all aspects of the partnership, leaving no room for ambiguity. Seeking legal advice during the drafting process is advisable to ensure the document aligns with Chinese legal standards.

Contract Manufacturing in China for Business Success

In today’s globalized business environment, setting up contract manufacturing in China has become an attractive option for companies seeking cost-effective production solutions, access to advanced manufacturing capabilities, and a gateway to one of the world’s largest consumer markets. China’s reputation as the “world’s factory” makes it a prime location for businesses looking to leverage its manufacturing expertise. This article will guide you through the essential steps and considerations for establishing contract manufacturing in China, with a focus on the resources available on business-china.ru.

Step 1: Research and Due Diligence

Before diving into the complexities of contract manufacturing in China, it’s crucial to conduct thorough research and due diligence. Business-china.ru offers valuable insights into the Chinese business landscape, providing information on legal requirements, industry regulations, and market trends. Familiarize yourself with the local business environment, cultural nuances, and potential challenges that may arise during the setup process.

Step 2: Identify a Reliable Partner

Selecting the right manufacturing partner is a critical decision that can significantly impact your business success. Business-china.ru may offer directories, reviews, and recommendations for reputable contract manufacturers in various industries. Consider factors such as production capabilities, quality control measures, compliance with international standards, and the manufacturer’s track record with other clients.

Step 3: Legal and Regulatory Compliance

Understanding and adhering to China’s legal and regulatory framework is imperative for a smooth and successful contract manufacturing setup. Business-china.ru can be a valuable resource for legal guidelines, licensing requirements, and compliance procedures. Ensure that you have a clear understanding of the relevant laws pertaining to your industry and product type.

Step 4: Negotiate Clear Terms and Agreements

Crafting comprehensive and transparent contracts is essential for mitigating risks and ensuring a successful partnership. Leverage business-china.ru to access sample contracts, negotiation tips, and best practices for working with Chinese manufacturers. Clearly define product specifications, quality standards, pricing structures, and delivery timelines in your agreements.

Step 5: Quality Control and Assurance

Maintaining consistent product quality is paramount when outsourcing manufacturing to China. Business-china.ru may provide insights into quality control processes, testing methodologies, and industry benchmarks. Consider implementing a robust quality control system, including on-site inspections and regular audits, to uphold your product standards.

Step 6: Logistics and Supply Chain Management

Efficient logistics and supply chain management are crucial components of successful contract manufacturing in China. Business-china.ru can offer information on transportation options, customs regulations, and warehousing solutions. Optimize your supply chain to minimize lead times and reduce costs while ensuring reliable delivery of finished goods.

Step 7: Communication and Relationship Building

Establishing open and effective communication channels with your Chinese manufacturing partner is vital for building a successful long-term relationship. Utilize resources on business-china.ru to understand cultural nuances, communication styles, and relationship-building strategies. Regular communication and mutual understanding can help address issues promptly and foster a collaborative partnership.

How to ensure the supply of quality products

In the dynamic and competitive landscape of the business world, ensuring a consistent and reliable supply of quality products is paramount for the success of any enterprise. For businesses operating in China, where the market is vast and opportunities abound, maintaining a high standard of product quality is crucial. This article aims to provide a comprehensive guide for businesses, specifically those affiliated with business-china.ru, on how to guarantee the supply of quality products.

- Establish Robust Supplier Relationships:

Building strong relationships with suppliers is the foundation of a reliable and high-quality supply chain. Conduct thorough research on potential suppliers, assess their production processes, quality control measures, and track record. Regular communication and collaboration with suppliers can foster transparency and trust, ensuring a smoother flow of quality products.

- Implement Stringent Quality Control Measures:

Implementing stringent quality control measures is vital to guarantee the consistency of products. Regular inspections, quality audits, and performance evaluations of suppliers can help identify and address potential issues early on. Utilize advanced technologies such as data analytics and artificial intelligence to enhance the precision and efficiency of quality control processes.

- Embrace Technology and Innovation:

Incorporating cutting-edge technology into the production and quality control processes can significantly enhance the overall quality of products. From automated manufacturing systems to real-time monitoring, technology can help identify defects, streamline processes, and improve overall efficiency.

- Continuous Monitoring and Improvement:

Quality assurance is an ongoing process that requires continuous monitoring and improvement. Establish key performance indicators (KPIs) to measure and evaluate the effectiveness of your quality control processes. Regularly review and update these KPIs to adapt to changing market conditions and customer expectations.

- Invest in Employee Training:

The human factor plays a crucial role in ensuring product quality. Investing in comprehensive training programs for employees involved in the production and quality control processes can enhance their skills and awareness. Well-trained staff are more likely to identify and address quality issues promptly, contributing to a higher overall standard.

- Compliance with Regulatory Standards:

Adhering to local and international regulatory standards is non-negotiable for businesses aiming to supply quality products. Stay informed about relevant regulations and ensure that your suppliers are also compliant. This not only ensures the quality and safety of products but also protects the reputation of your business.

- Diversify and Backup Suppliers:

Relying on a single supplier can pose a significant risk to the continuity of your supply chain. Diversify your supplier base and establish backup suppliers to mitigate potential disruptions. This strategy adds a layer of resilience to your supply chain, ensuring that you can maintain a steady flow of quality products even in the face of unforeseen challenges.

Business

Pilot Flying J Careers: Soaring to New Heights in the Transportation Industry

Table of Contents

- Introduction

- The Journey with Pilot Flying J

- A Company with a Rich History

- An Array of Opportunities

- Cultivating a Healthy Work Environment

- Career Growth and Development

- The Benefits of Working with Pilot Flying J

- Joining the Team: How to Apply

- The Interview Process

- Success Stories: Employee Testimonials

- Commitment to Diversity and Inclusion

- Community Engagement

- Conclusion

- Frequently Asked Questions

- Frequently Asked Questions

- Frequently Asked Questions

- Frequently Asked Questions

- Frequently Asked Questions

Introduction

Are you ready to embark on an exciting Pilot Flying J Careers journey in the transportation industry? If so, you’ve come to the right place. Pilot Flying J, a leading travel center operator, is not only committed to serving travelers but also dedicated to fostering fulfilling and rewarding careers for its employees. In this article, we’ll explore the world of Pilot Flying J careers, the opportunities they offer, and what makes them stand out in the job market.

The Journey with Pilot Flying J

Pilot Flying J is a company that prides itself on its commitment to providing top-notch service to travelers across North America. With over 750 travel centers, they are a beacon of comfort and convenience for people on the road. Their workforce is the backbone of their success, and they offer a wide range of career opportunities.

A Company with a Rich History

Founded in 1958 by James Haslam II, Pilot Flying J has grown from a small service station to one of the largest travel center networks in the United States. Over the years, they have developed a reputation for excellence and have become a recognized brand in the industry.

An Array of Opportunities

Pilot Flying J provides a plethora of career opportunities, from entry-level positions to management roles. Whether you’re interested in retail, restaurant management, IT, or operations, there’s a place for you in their team. They value diversity and continuously seek talented individuals to join their workforce.

Cultivating a Healthy Work Environment

A crucial aspect of Pilot Flying J is its commitment to fostering a healthy work environment. They believe in a work culture that promotes teamwork, open communication, and a sense of belonging. Employee well-being and safety are paramount to the company, and they offer various programs and benefits to support their workforce.

Career Growth and Development

Pilot Flying J Careers is not just a workplace; it’s a place for personal and professional growth. They provide training and development opportunities to help their employees advance in their careers. Many of their current leaders began as entry-level employees, demonstrating their commitment to internal promotion and development.

The Benefits of Working with Pilot Flying J

Working at Pilot Flying J comes with a multitude of benefits, including competitive pay, medical and dental insurance, 401(k) plans, and more. Additionally, employees enjoy discounts on meals, fuel, and travel services, making it even more rewarding to be part of the team.

Joining the Team: How to Apply

Ready to embark on your career journey with Pilot Flying J? The application process is straightforward. Visit their website and explore the available positions. Once you find the perfect fit, submit your application online.

The Interview Process

Pilot Flying J takes the interview process seriously. They want to ensure that both you and the company are the right fit for each other. Expect a thorough interview process that assesses your skills, experience, and your ability to thrive in their dynamic work environment.

Success Stories: Employee Testimonials

Don’t just take our word for it; listen to the success stories of Pilot Flying J employees. Their firsthand experiences can provide valuable insights into the opportunities and growth potential that this company offers.

Commitment to Diversity and Inclusion

Pilot Flying J is committed to diversity and inclusion. They believe that a diverse workforce brings a variety of perspectives and strengths to the table. They actively work to create an inclusive environment where everyone feels valued and empowered.

Community Engagement

Pilot Flying J is not only committed to its employees but also to the communities in which they operate. They actively engage in community initiatives and charitable work, further emphasizing their commitment to making a positive impact.

Conclusion

In conclusion, Pilot Flying J careers are more than just jobs; they are opportunities for growth, development, and fulfillment. The company’s commitment to its employees, diverse work culture, and dedication to the community make it an ideal place for those seeking a rewarding career in the transportation industry.

Frequently Asked Questions

- How can I apply for a job at Pilot Flying J?

- What is the interview process like?

- What benefits are offered to employees?

- Can you provide examples of employee success stories at Pilot Flying J?

- How does Pilot Flying J support community engagement and charitable initiatives?

Get ready to take flight in your career by joining Pilot Flying J. Visit their website and explore the opportunities available to start your journey today!

Business

The Ultimate Guide to Cbdreakiro

CBD Reakiro is a UK-based company that offers a range of premium quality CBD products. With a commitment to providing natural and safe products, CBD Reakiro is quickly becoming a leading brand in the UK and Europe.

CBD Reakiro offers a variety of CBD products, including oils, capsules, topicals, and e-liquids. All of their products are made using organically grown hemp and undergo rigorous testing to ensure they meet high standards of quality and purity.

CBD Paste UK

CBD products have taken the world by storm in recent years due to their numerous health benefits. Among the different types of CBD products available in the market, CBD paste has become increasingly popular in the UK.

CBD paste the UK is a concentrated form of cannabidiol (CBD) extracted from the hemp plant. It is a thick, sticky substance that is rich in cannabinoids, terpenes, flavonoids, and other beneficial plant compounds. CBD paste is often used as a natural alternative to traditional medicines for managing various health conditions.

At CBD Reakiro, we offer a range of CBD paste products that are specially formulated to cater to the specific needs of our customers. Our CBD paste UK collection is made from premium quality hemp plants grown in the EU, and is extracted using state-of-the-art technology to ensure maximum purity and potency.

Benefits of CBD Paste UK

CBD paste is known for its wide range of health benefits. Some of the most notable benefits of CBD paste UK include:

Pain Relief:

CBD paste has natural analgesic properties that can help relieve chronic pain caused by conditions like arthritis, multiple sclerosis, and fibromyalgia.

Anxiety and Depression:

CBD paste can help alleviate symptoms of anxiety and depression by interacting with serotonin receptors in the brain.

Neuroprotective Properties:

CBD paste has neuroprotective properties that can help protect the brain from damage caused by conditions like Alzheimer’s and Parkinson’s disease.

Anti-inflammatory:

CBD paste has anti-inflammatory properties that can help reduce inflammation in the body, which is linked to many chronic health conditions.

Improved Sleep:

CBD paste can help improve sleep quality and quantity by reducing anxiety and promoting relaxation.

How to Use CBD Paste

CBD paste can be used in various ways, depending on the individual’s preference and the desired effect. Some of the most common ways to use CBD paste include:

Sublingual Administration:

Place a small amount of CBD paste under the tongue and hold it there for 60-90 seconds before swallowing. This method is believed to offer the quickest onset of effects.

Topical Application:

CBD paste can be mixed with a carrier oil and applied topically to the skin to relieve pain and inflammation.

Inhalation:

CBD paste can be added to a vaporizer and inhaled to provide quick relief from symptoms.

CBD paste is a powerful natural remedy that offers a wide range of health benefits. At CBD Reakiro, we offer a range of premium quality CBD paste products that are specially formulated to meet the unique needs of our customers. Whether you are looking for relief from pain, anxiety, or inflammation, our CBD paste UK collection has got you covered.

Reakiro Raw Hemp Extract RxPen

https://cbdreakiro.co.uk is a well-known company in the hemp and CBD industry that produces high-quality, organic, and natural CBD products. One of their popular products is the Reakiro Raw Hemp Extract RxPen, which is a unique and convenient way of consuming CBD.

What is Reakiro Raw Hemp Extract RxPen?

The Reakiro Raw Hemp Extract RxPen is a CBD product that is designed to be used as a vaporizer. It is a pen-like device that contains a cartridge filled with raw hemp extract that has not undergone any refining process. The raw hemp extract contains a full spectrum of cannabinoids, terpenes, and flavonoids, making it a potent and effective CBD product.

The Reakiro Raw Hemp Extract RxPen is made from high-quality materials, and it is designed to be durable and long-lasting. The device is easy to use, and it is rechargeable using a USB port. It also has a sleek and stylish design that makes it easy to carry around.

How to Use Reakiro Raw Hemp Extract RxPen?

Using the Reakiro Raw Hemp Extract RxPen is straightforward. To get started, you need to remove the protective cap from the device and attach the cartridge to the battery. Once the cartridge is in place, you can turn on the device by pressing the button located on the battery.

When the device is turned on, you can start inhaling through the mouthpiece, and the device will start to vaporize the raw hemp extract. The vapor that is produced is smooth and flavorful, and it delivers all the beneficial compounds that are present in the raw hemp extract.

The Reakiro Raw Hemp Extract RxPen is an ideal product for those who are looking for a quick and convenient way to consume CBD. It is perfect for those who are always on the go and need a CBD product that is easy to use and carry around.

Benefits of Reakiro Raw Hemp Extract RxPen

The Reakiro Raw Hemp Extract RxPen offers a range of benefits to its users. Firstly, it delivers a full spectrum of cannabinoids, terpenes, and flavonoids, which work together to produce the entourage effect. This effect is believed to enhance the therapeutic benefits of CBD.

Secondly, the device is easy to use and convenient to carry around, making it an ideal product for those who are always on the go. It also produces a smooth and flavorful vapor that is easy to inhale, making it a great option for those who don’t like the taste of traditional CBD oil.

Finally, the Reakiro Raw Hemp Extract RxPen is made from high-quality materials, and it is designed to be durable and long-lasting. This makes it a cost-effective option for those who want to enjoy the benefits of CBD without having to constantly replace their device.

CBD Reakiro Products

One of the things that sets CBD Reakiro apart from other CBD companies is their commitment to quality. The company uses only the best hemp plants that are grown using organic methods to produce their CBD products.

CBD Oils

Our CBD oils are made with high-quality hemp extract and are available in various strengths to suit your needs. They are easy to use, with a dropper that allows you to measure out your desired dose. Here are some of the benefits of our CBD oils:

- Support healthy sleep patterns

- Promote relaxation and reduce stress

- Improve focus and mental clarity

- Alleviate discomfort and soreness

CBD Capsules

If you prefer a more convenient way to take CBD, our capsules are an excellent option. Each capsule contains a precise amount of CBD, making it easy to track your daily intake. Some of the benefits of our CBD capsules include:

- Promote calm and relaxation

- Support healthy joint function

- Boost immune system function

- Encourage a sense of balance and well-being

CBD Edibles

Our CBD edibles are a delicious and discreet way to enjoy the benefits of CBD. We offer a variety of options, including gummies, chocolates, and even CBD-infused honey. Here are some of the benefits of our CBD edibles:

- Promote a sense of calm and relaxation

- Support healthy digestion

- Improve sleep quality

- Boost immune system function

CBD Skincare

Our CBD skincare products are specially formulated to nourish and protect your skin. They are made with premium ingredients and contain a blend of CBD, essential oils, and other beneficial compounds. Here are some of the benefits of our CBD skincare range:

- Hydrate and moisturize dry skin

- Reduce the appearance of fine lines and wrinkles

- Soothe and calm irritated skin

- Promote a healthy, radiant complexion

Why Choose Cbd reakiro for CBD Products?

CBD (cannabidiol) is a compound that has gained significant popularity over the years due to its potential health benefits. It has been used to treat various conditions such as anxiety, chronic pain, inflammation, and even some forms of epilepsy. As a result, there has been an increase in the number of companies that produce CBD products. One of the leading companies in this industry is CBD Reakiro, we’ll take a closer look at why CBD Reakiro should be your go-to brand for CBD products.

Quality Products:

CBD Reakiro takes pride in the quality of its products. They use premium quality raw materials and state-of-the-art technology to produce their products. All their products undergo rigorous testing to ensure their safety and effectiveness. CBD Reakiro products are manufactured using hemp that is organically grown and harvested, free from pesticides, and non-GMO. The extraction process is done using CO2 extraction, which ensures that no harmful solvents or chemicals are used.

Broad Range of Products:

CBD Reakiro offers a broad range of CBD products to cater to different needs. They have CBD oils, capsules, skincare products, and even pet products. This makes it easy for customers to choose the product that best suits their needs.

Transparency:

CBD Reakiro is transparent about the quality of its products. They provide third-party lab reports that show the potency and purity of their products. This gives customers confidence in the products they purchase.

Customer Satisfaction:

CBD Reakiro values its customers and strives to provide excellent customer service. They have a team of professionals who are available to answer any questions customers may have. They also have a return policy that allows customers to return products that do not meet their expectations.

Competitive Pricing:

CBD Reakiro offers competitive pricing for its products. They understand that CBD products can be expensive, and as such, they provide affordable options without compromising on quality.

-

Entertainment1 year ago

Entertainment1 year agoAdmiral casino biz login

-

Entertainment2 years ago

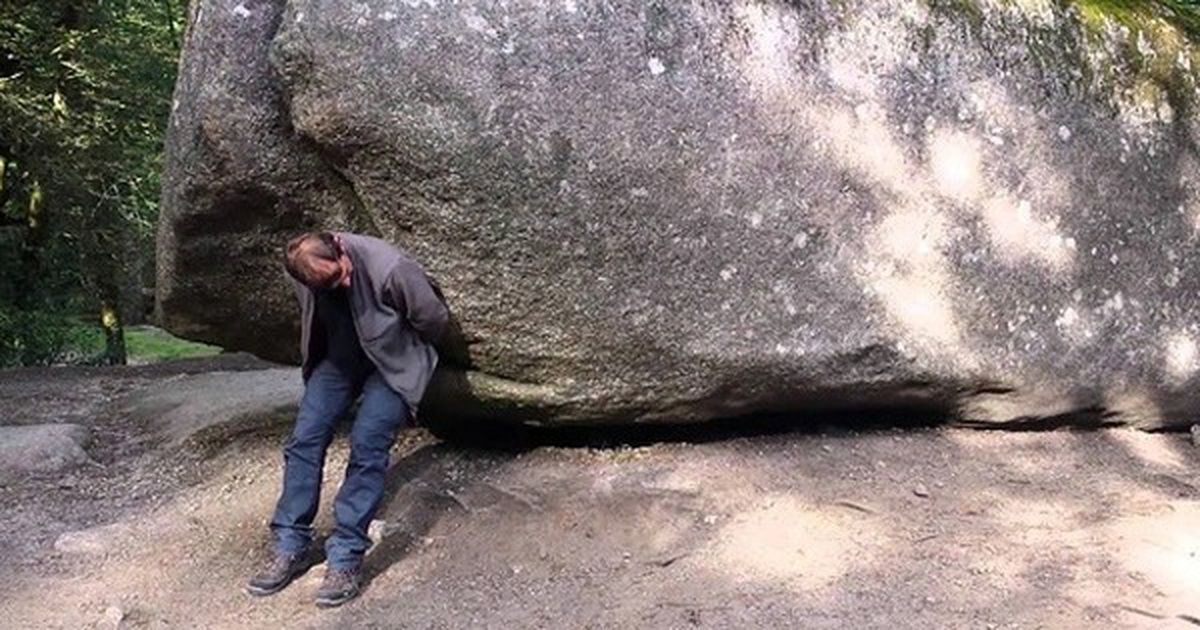

Entertainment2 years agoHow Much Does The Rock Weigh

-

Entertainment2 years ago

Entertainment2 years agoDownload Popular Latest Mp3 Ringtones for android and IOS mobiles

-

Entertainment2 years ago

Entertainment2 years agoTop 10 Apps Like MediaBox HD for Android and iPhone

-

LIFESTYLE2 years ago

LIFESTYLE2 years agoWhose Heartland?: The politics of place in a rural–urban interface

-

Fashion3 years ago

Fashion3 years agoHow fashion rules the world

-

Fashion Youth2 years ago

Fashion Youth2 years agoHow To Choose the Perfect Necklace for Her

-

Fashion Today2 years ago

Fashion Today2 years agoDifferent Types Of lady purse